The digital transformation is not stopping at the banking sector either, with online banking trends becoming particularly apparent. A recent survey by the Gesellschaft für Qualitätsentwicklung in der Finanzberatung and Splendid Research confirms that the demand for online services among bank customers is steadily increasing. From online advice and innovative self-check apps to chat robots - a third of respondents already prefer these modern online banking services. This development reflects a significant change in customer needs, with proximity to the location and the quality of e-banking among the top priorities alongside the trustworthiness of a bank.

Demand from bank customers

According to a survey conducted by the Society for Quality Development in Financial Advice and the market research institute Splendid Research, digital services are also increasingly in demand at banks. A third of those surveyed already take online advice calls and use self-check apps and chat robots.

For the respondents, the three most important criteria for a bank include

- the trustworthiness

- A nearby location

- Good e-banking

On-site advice is obviously on the decline, as only half of customers still want it. Digitalization is now also gaining ground in the banking sector and the helpers and tools are increasingly being deployed and used. For many, e-banking would be indispensable. In addition, 52% of respondents want to make appointments online. What is commonplace at hairdressers, restaurants or in many car dealerships should also be implemented in banks. Difficult to estimate the consultation time? No. Customers want a maximum consultation time of 45 minutes. Allow 15 minutes for preparation and follow-up time - et voilà! As we all know, time is money!

Banks in Germany ...

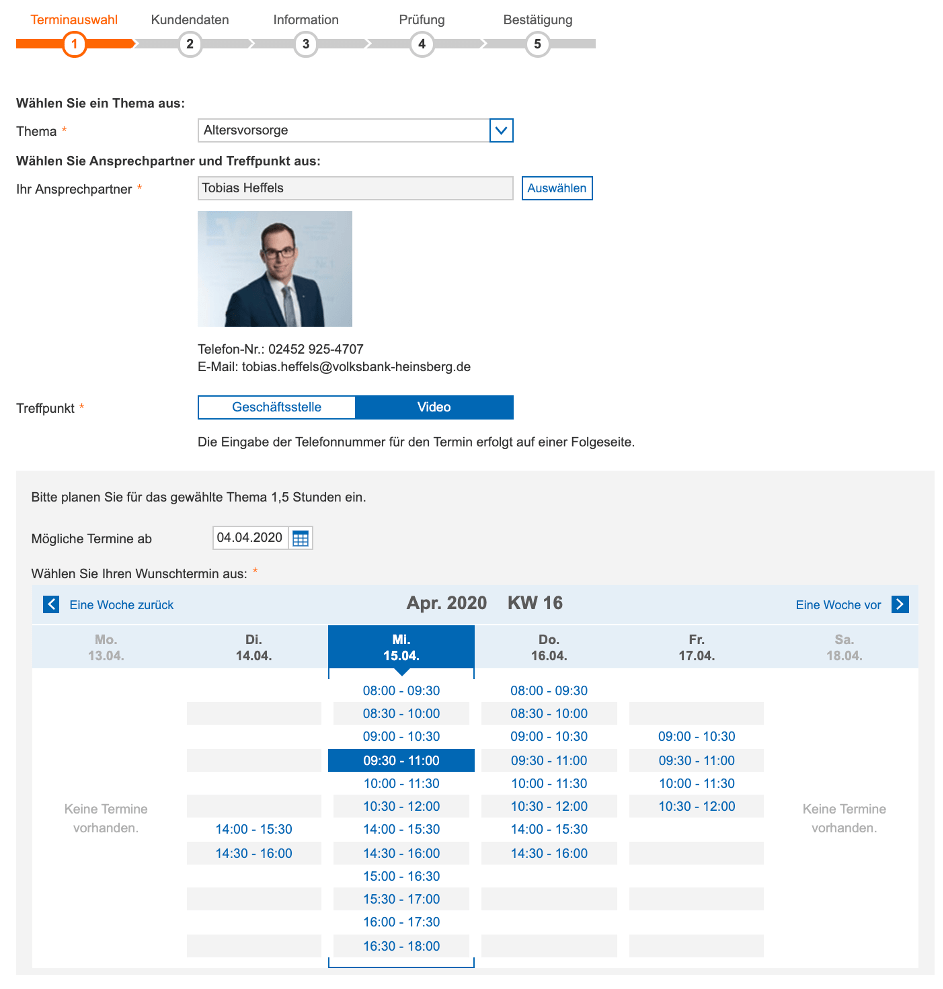

Obviously, the Volksbanken and Raiffeisenbanken in Germany have developed a holistic tool for all banks. The various VR banks, Sparda banks and Volksbanks all use the same service. The tool is very easy to use. Customers can book an appointment with an advisor on a specific topic at the desired time, either with or without a login. VR Bank also offers contact by phone, chat and video.

However, other banks in Germany offer online appointments. These include Spreewaldbank eG1savings banks2, Targo Bank3 and Psd Bank4. It is often not possible to select an advisor with these tools and only a preferred date can be selected. This in turn requires additional confirmation and causes unnecessary effort. As a result, there is no dynamic comparison with the advisors in the background and the appointment has to be confirmed manually. However, it is important that the banks have responded to customers' wishes and offer the required online appointment scheduling, which is increasingly being used.

... Austria ...

The ING banks in particular stand out here in the context of current online banking trends. They offer customers an online appointment system, but this is somewhat sparse compared to more advanced systems. Customers have the option of filling out a simple form, but this does not offer the comprehensive online appointment scheduling functions implemented by providers such as Calenso. This form at ING Banks does not offer advisor selection and does not calculate free appointments in the background, which sets it apart from other, more advanced solutions in the online banking trend.

... and banks in Switzerland

Switzerland is once again characterized by its diversity, which is also reflected in the current online banking trends. Each bank offers its own scheduling system, which has both advantages and disadvantages. Luzerner Kantonalbank (LUKB) was one of the first banks in Switzerland to enable its customers to make appointments online back in 2016, an early example of the trend towards more digital banking services. UBS also offers its customers online appointment scheduling, the functionality of which is very similar to that of the ING banks. Here, bank customers can only request a callback appointment, without the option of selecting an advisor, an absolute booking or a dynamic calculation of free appointments - an aspect that could be further developed in the context of the advancing online banking trends.

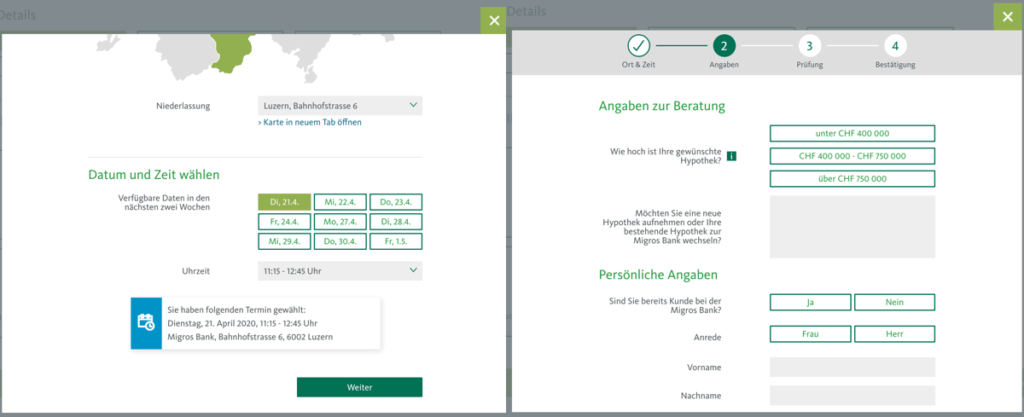

Migros Bank

Migros Bank offers a somewhat more sophisticated appointment booking service. First, the customer selects a topic, e.g. mortgages. A window then opens for making an appointment online. After selecting the location and time, a specific question for the selected subject area follows. Then all that remains is to fill in the personal details and the appointment is made. It is a pity that there is no dynamic comparison for the customer advisor. However, it has a very intuitive design for the customer. The online appointment system has been well received by customers. Around 10 appointments are made online every day, with the topic of mortgages dominating 80% of the appointments.5 In our opinion, Migros Bank does not yet have the online appointment scheduling that would be possible.

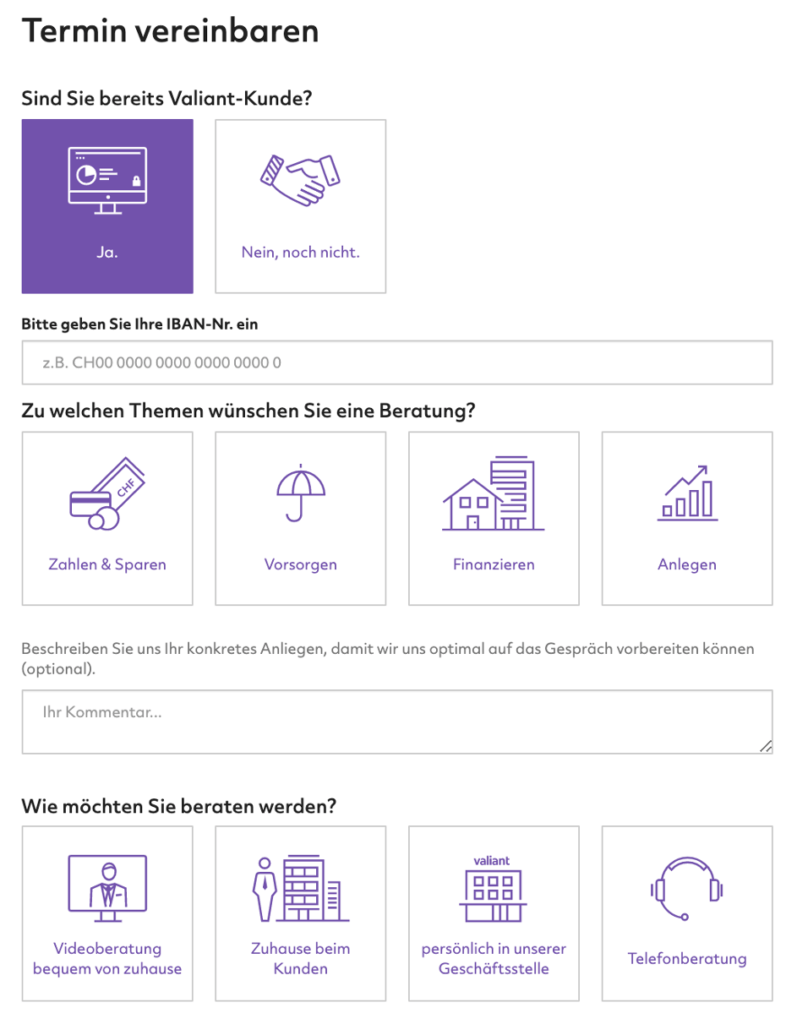

The Valiant Bank

We would therefore like to present the example of Valiant Bank. Customers can make an appointment with or without a bank account. For existing customers, the system automatically recognizes the customer advisor using the IBAN number. Depending on the complexity of the topic, the customer then books an appointment by telephone, video consultation, at home or on site at the branch. This is followed by a confirmation e-mail with all the necessary information and documents required for the appointment. Valiant has set itself the goal of simplifying financial life for customers. They are a model bank in the age of digitalization. In addition to making appointments online, customers have the option of using other services to manage their financial affairs independently. This is why there are connections to Bexio or Klara for SMEs.

The Nidwaldner Kantonalbank

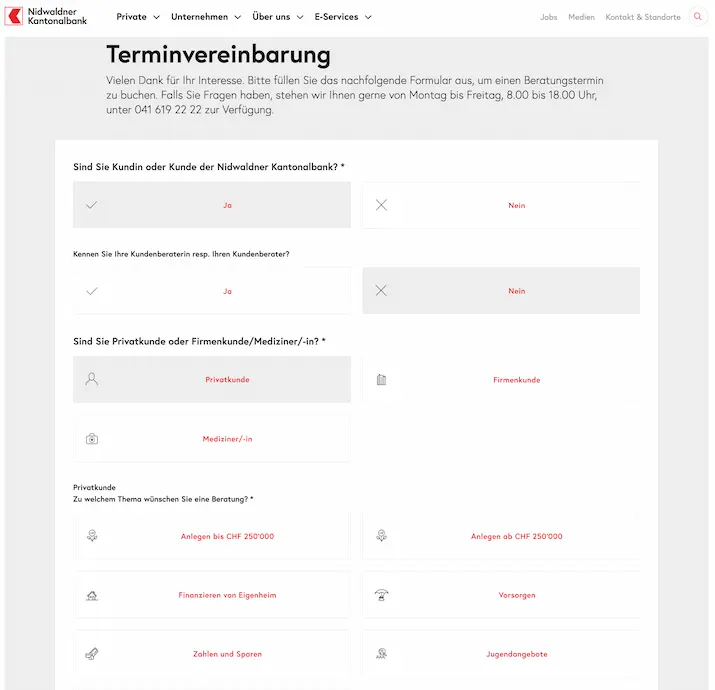

Nidwaldner Kantonalbank is taking a significant step towards digitalization and customer service. With its new online appointment system, which was developed in collaboration with Calenso, the bank now offers its customers an even more flexible and efficient way of scheduling consultations. This innovative, browser-based solution allows users to conveniently book an appointment for a consultation on their preferred topic. A special feature of this service is the freedom for customers to choose the location of the consultation and even select a specific consultant if required. This applies regardless of whether or not they already have a customer relationship with the bank.

The introduction of this online appointment system is a clear commitment by Nidwaldner Kantonalbank to modern banking that is geared towards the needs and convenience of customers. By partnering with Calenso and their expertise in digital solutions, the bank sets itself apart from traditional approaches and once again demonstrates its ability to effectively use innovative technologies to improve customer interaction. With this step, the bank emphasizes its role as a pioneer in digital transformation and demonstrates its commitment to enabling customers to spend more time on what matters.

Digital trends and innovations

An article in HZ Insurance highlights the importance of digital innovations in the financial sector and shows how banks are adapting to trends and changing customer needs. This trend is also confirmed in the "IFZ Digital Insurance Experience Study 2023". The study underlines the growing need for financial institutions to implement digital solutions in order to remain competitive.

This is reflected in the efforts of Nidwaldner Kantonalbank, which has introduced an advanced online appointment system in partnership with Calenso. Through these innovations, the bank is positioning itself as a role model in the digital transformation by not only reacting to current developments, but also actively shaping them. The combination of the findings from the IFZ study and the trends identified by HZ Insurance confirms the strategic direction of Nidwaldner Kantonalbank and emphasizes its role as a pioneer in an increasingly digitalized financial world.