In the past, interaction with insurance companies was mainly based on face-to-face conversations or phone calls. However, with rapid technological advancements and changing customer expectations, insurance companies have recognized the need to adapt and evolve their digital services. Today, at Calenso, we hear time and time again from both existing and potential customers how crucial omnichannel appointment scheduling has become.

In the modern insurance industry, customers are increasingly demanding and expect seamless, personalized experiences across different communication channels. To meet these expectations, insurance companies are increasingly turning to omnichannel strategies. But what exactly distinguishes omnichannel from multichannel, and why is this approach crucial for the insurance industry?

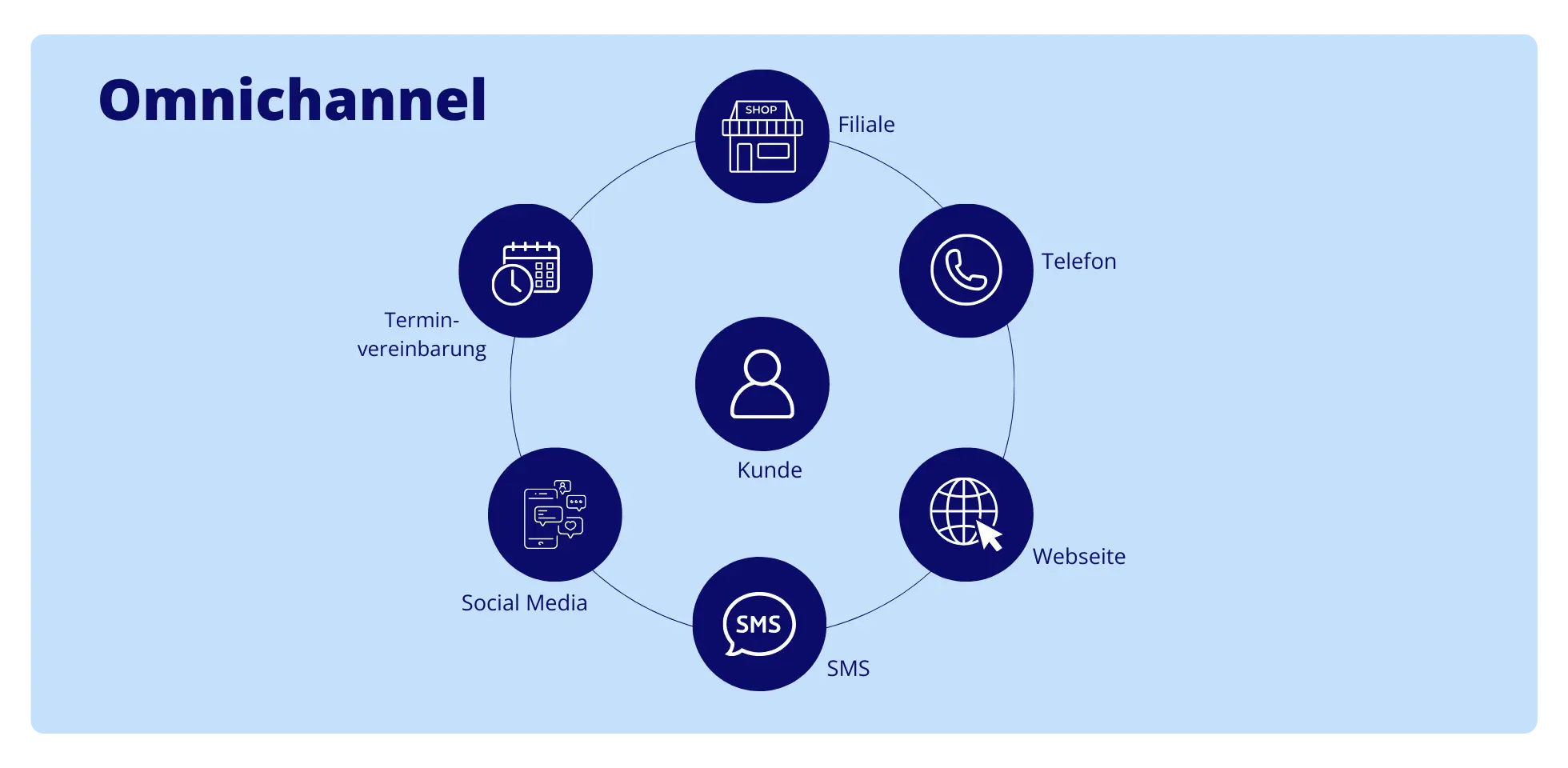

What is omnichannel and multichannel?

In the insurance industry, terms such as omnichannel and multichannel, which you hear a lot, are crucial to improving customer communication and interaction. Although they are often used interchangeably, they are fundamentally different in their approach and implementation. These differences are essential to understanding how insurers can best reach and serve their customers. The definitions and key differences between these two strategies are explained below.

What is omnichannel?

The omnichannel strategy integrates all channels that a company uses to provide a seamless, consistent and personalized customer experience. This involves tracking and consolidating all customer interactions across different channels to ensure a consistent experience. For example, a customer can start their insurance inquiry by email, receive further information over the phone and finally complete the policy online without any information being lost or processes being interrupted.

Do your customers find it difficult to book appointments flexibly and conveniently?

With Calenso, your customers can easily book appointments via apps, social media and other digital platforms.

Benefits of omnichannel for customers and companies

By implementing an omnichannel strategy, insurance companies can significantly increase both customer satisfaction and operational efficiency. This strategy offers numerous advantages, which are explained below:

- Increased customer satisfaction and loyalty: Seamless integration of all channels creates a consistent and personalized experience that puts the customer at the center.

- Efficiency and flexibility: Customers can interact with their insurer at any time and through any preferred channel, increasing flexibility and accessibility.

- Data integrationA central database enables insurers to gain comprehensive customer insights and create personalized offers.

An example to illustrate this: A customer starts their inquiry about household contents insurance on the website and receives initial information there. He later contacts the hotline for detailed information. Thanks to the seamless integration of all channels, the hotline employee has access to previous interactions and can immediately follow up on the online inquiry. The customer does not have to repeat their information, resulting in a seamless experience. In addition, the customer can interact with their insurance company at any time and via their preferred channel - whether by app, email or phone - which increases flexibility. A central database collects all customer interactions, allowing the insurance company to create personalized offers. If the customer frequently searches for specific cover options, the system can automatically create and send them a tailored quote, increasing relevance and satisfaction.

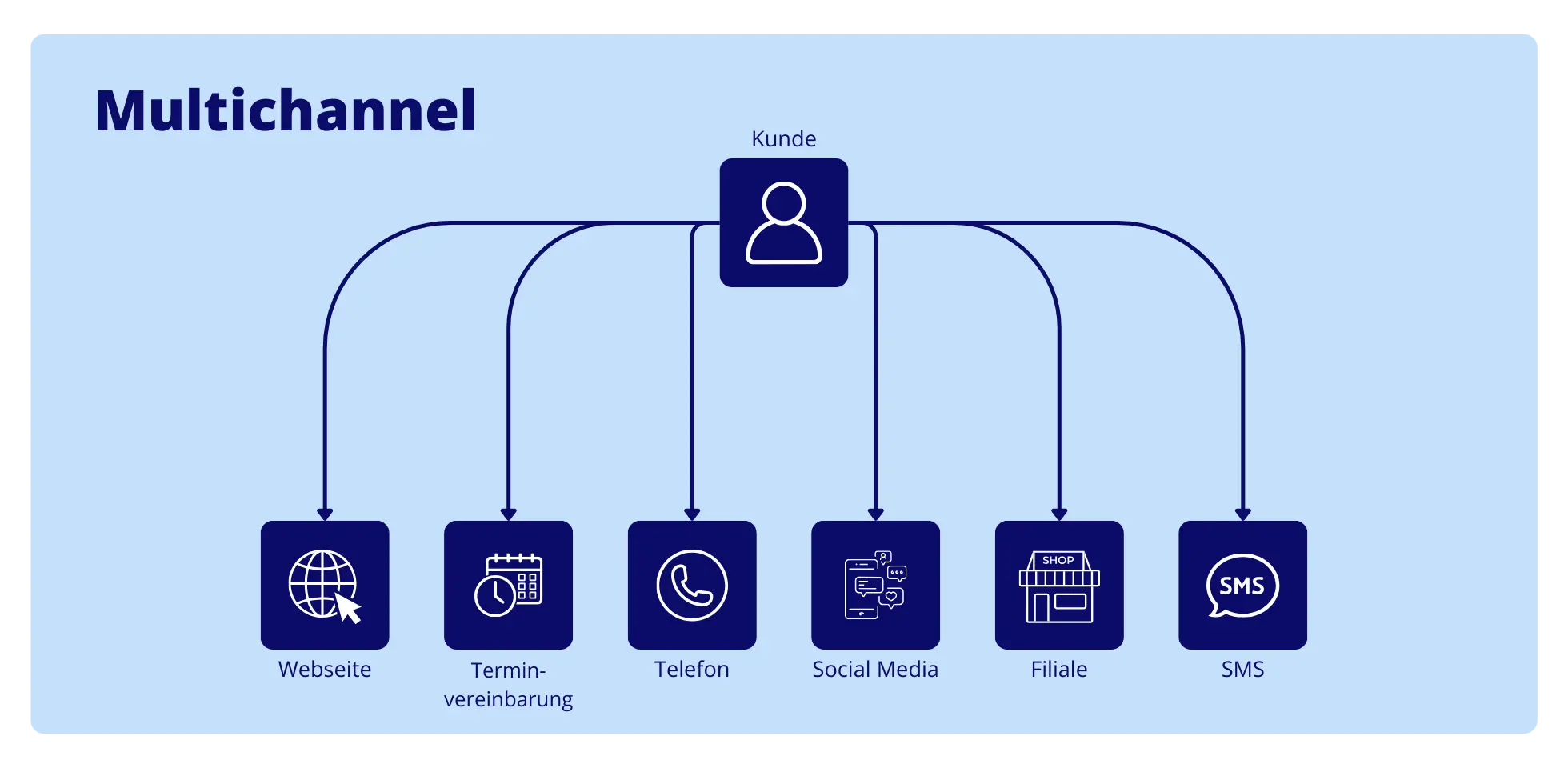

What is multichannel?

The multichannel strategy involves using several channels to communicate with customers and offer products or services. However, these channels are not integrated and work independently of each other. For example, an insurance company may operate both a website and a hotline, but the interactions via these channels are not linked.

Challenges compared to omnichannel

Although multichannel strategies offer several communication and sales channels, they lack the integration and coherence that characterize a true omnichannel strategy. This leads to several challenges for insurance companies and their customers.

- No consistent customer journey: Customers may have to repeat their requests and information multiple times when switching between different channels.

- Data silos: Information is stored in isolated systems, making it difficult to gain a holistic view of the customer and personalized interactions.

Start free of charge with omnichannel appointment scheduling

What exactly is single-channel?

In contrast to modern omnichannel and multichannel approaches, customer communication used to be based on a single-channel approach. This means that interaction took place exclusively via a single channel, such as personal contact or telephone.

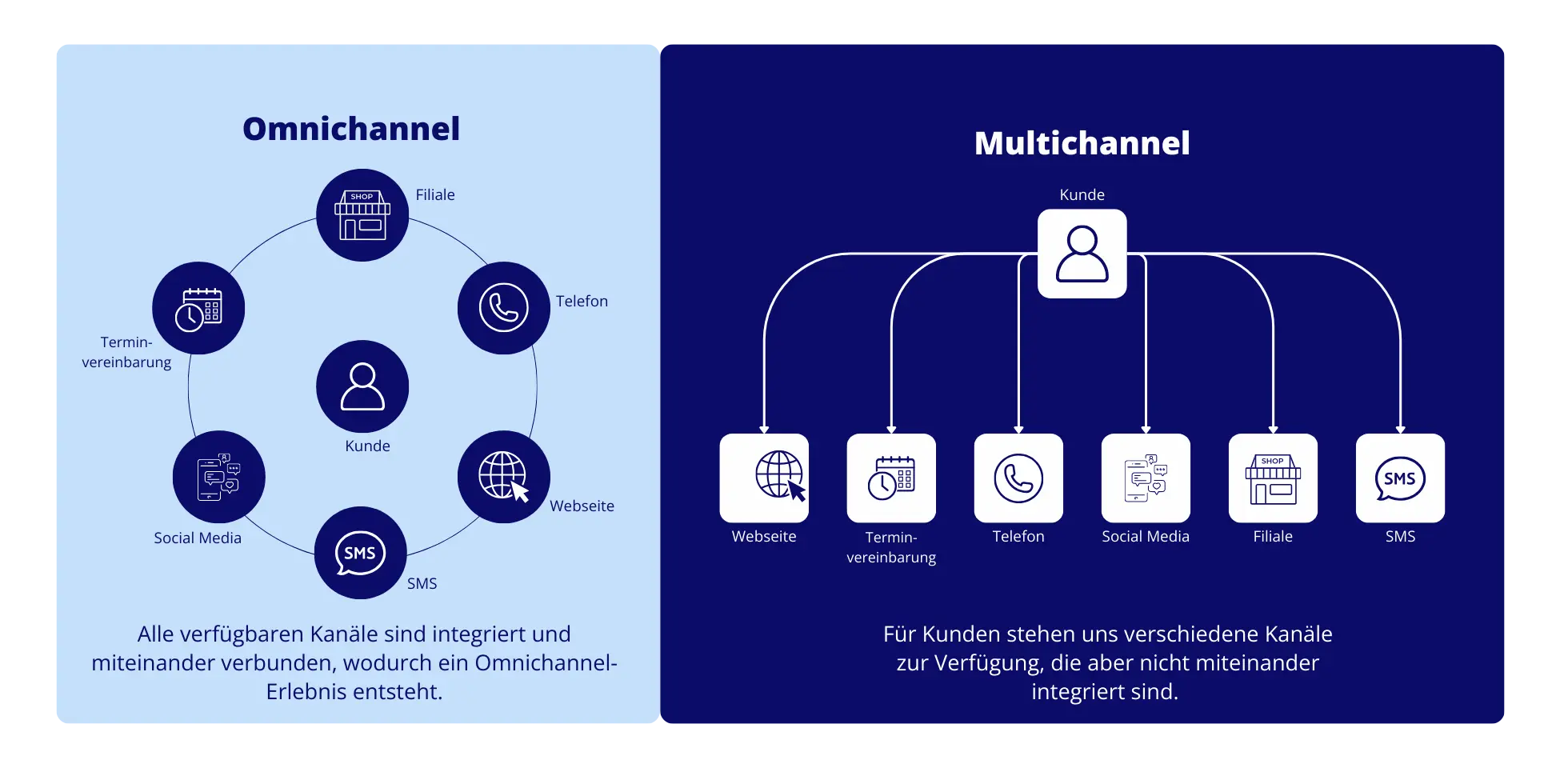

Differences between omnichannel and multichannel

The main differences lie in the degree of integration and the customer experience. While multichannel strategies use multiple, independent channels, omnichannel strategies merge all channels into a single, seamless experience. This leads to improved customer satisfaction and more efficient processes. A visual representation can help to make these differences clearer:

- Benefits of omnichannel in the insurance industry: Omnichannel strategies offer numerous advantages for insurance companies that want to increase their customer satisfaction and optimize their internal processes.

- Meeting customer expectations: Today's customers prefer digital channels and expect flexibility. According to a study by Baloise, 25% of insurance contracts are already concluded via digital channels. An omnichannel approach enables insurers to meet these expectations and achieve higher customer satisfaction.

- Flexibility and convenience: Customers can communicate with their insurance company via their preferred channel, be it by phone, email, chat or in person. This offers a high degree of flexibility and increases convenience for the customer.

- Increased efficiency: Optimized use of resources and faster response times to customer inquiries enable insurance companies to significantly increase their efficiency.

- Increase customer satisfaction and loyalty: A seamless and personalized customer experience leads to greater satisfaction and strengthens customer loyalty to the insurance company.

Omnichannel solution for insurance companies - Calenso

Calenso offers comprehensive omnichannel solutions for insurance companies that integrate appointment booking and scheduling across all relevant channels.

- Omnichannel appointment booking: customers can book appointments via the website, an app, by phone or in person. All channels are linked so that customers can switch seamlessly between them.

- Appointment schedulingThe software enables both virtual and face-to-face consultations. Customers can choose flexibly between these options.

- Data security and data protection: Calenso ensures that all data meets the highest security standards and is fully GDPR compliant.

- BrandingThe platform can be adapted to the corporate design of the insurance company to ensure a consistent brand presence.

- Integration and adaptability: Calenso's customer engagement solutions can be easily integrated into existing systems and business processes and adapted to the individual needs and business processes of the insurance company.

Discover all other functions here→

Success stories: Sanitas and Helvetia

The successful implementation of omnichannel strategies by Calenso has already proven itself several times in the insurance industry. Two outstanding examples of this are the projects with Sanitas Krankenversicherung and Helvetia Versicherung. These case studies show how the use of Calenso's solutions can lead to an improved customer experience and efficiency.

This is what the digital sales process looks like at Sanitas

Sanitas has successfully implemented Calenso's digitalization suite to streamline appointment bookings and ensure a seamless customer experience. This omnichannel strategy allows customers to book their appointments through various channels, including the Sanitas website, a mobile app and by phone. This creates a consistent and convenient interaction with the insurance company, regardless of the customer's preferred communication channel.

Omnichannel strategy in detail:

- Integration of all channels: Sanitas has consolidated all customer interactions across different channels. This means that a customer who starts their inquiry by email can follow it up later by phone or in person without having to provide information again.

- Central database: All customer data is stored in the CRM, which enables employees to access complete customer profiles at any time and offer personalized services.

- Real-time synchronization: The synchronization of all channels in real time ensures that customer information and appointment availability are always up to date. This reduces waiting times and avoids double bookings.

- Flexibility and convenience: Customers can book, change or cancel their appointments online whenever it suits them, while also having the option to speak directly to an advisor if they prefer.

- Automated reminders: Automated email and SMS reminders help increase appointment adherence and remind customers of their upcoming appointments.

Results of the omnichannel strategy:

- Increase in appointment bookings: Thanks to the simple and flexible appointment booking, the number of bookings increased significantly.

- Increased efficiency: The integration of all channels and the central database led to more efficient management of customer interactions.

- Higher customer satisfaction: The seamless and personalized experience led to a significant increase in customer satisfaction and loyalty.

Find out more about Sanitas' omnichannel strategy

Omnichannel customer engagement at Helvetia Insurance

Helvetia has created an innovative customer interaction by implementing Calenso's solutions, utilizing virtual consultations and a consistent user experience in a unified design. This enables Helvetia to offer its customers a modern and flexible advisory experience.

Virtual consultations and Metaverse in detail:

- Virtual consultations: Customers can book consultation appointments online via the Helvetia website or app and then connect with an advisor via video call. This gives customers the flexibility to conduct consultations from anywhere without having to be physically present.

- Appointment booking: Helvetia enables easy and flexible appointment booking across multiple channels. Customers can make appointments both online and by phone, ensuring a seamless integration and user experience.

- Metaverse integration: Helvetia uses the Metaverse to offer an immersive advisory experience. Customers can enter a digital environment via virtual reality (VR), where they can experience interactive presentations, product demonstrations and personal consultations.

- 360-degree customer view: By centrally storing all customer interactions, Helvetia can ensure a comprehensive view of the customer, enabling personalized advice and tailor-made offers.

- Integration of digital channels: All digital interactions are seamlessly integrated into Helvetia's existing systems, ensuring a consistent experience across all channels.

- Real-time feedback: Customers can provide feedback on their virtual consultations in real time, which enables Helvetia to continuously improve its services.

Results of the virtual consultations and Metaverse integration:

- Positive feedback: Customers appreciate the flexibility and modernity of virtual consultations and the Metaverse experience, which is reflected in positive feedback.

- Increased use of digital channels: The innovative use of digital channels led to increased interaction and use by customers.

- Improved customer satisfaction: The ability to carry out consultations flexibly and from any location significantly increased customer satisfaction.

Virtual consultations in the insurance industry - Helvetia welcomes customers in the Metaverse

Changes in customer behavior

Customer behavior is constantly changing, and forecasts and trends show that customers will rely even more heavily on digital channels in the coming years. A study by BCG shows that 25% of insurance contracts are already concluded via digital channels, and this proportion will continue to grow. Customers increasingly expect flexibility and convenience in their interaction with insurance companies, whether via mobile apps, social media or other digital platforms. Online appointment booking is of great importance here, as it enables customers to book appointments for advice quickly and easily.

Conclusion

Omnichannel strategies are the key to meeting modern customer needs in the insurance industry. They not only offer a seamless and personalized customer experience, but also numerous benefits for insurance companies, including increased efficiency, flexibility and customer satisfaction. Calenso is the ideal partner for insurance companies to successfully implement this strategy and prepare for the future. Contact us to find out more about our solutions and how we can help you implement your omnichannel strategy.

To remain competitive, insurance companies must continuously respond to these changing needs and preferences. This means that they must not only expand their digital offerings, but also ensure that these offerings are seamlessly integrated into a comprehensive omnichannel strategy. Calenso helps insurers meet this challenge by providing flexible and customizable solutions that can be easily integrated into existing systems.