The insurance industry is facing fundamental change, shaped by technological innovations and changing customer behavior. Environmental, operational and technological changes have contributed to the evolution of the industry and are driving economic growth. The future of insurance distribution lies in multi-access solutions that complement direct sales by agents and brokers through various online and offline channels.

With increasing technology, consumer expectations are rising when buying insurance via different channels. A McKinsey study sheds light on these developments and shows how trends in insurance sales and multi-access solutions will develop.

How is changing is insurance sales changing?

Insurance distribution methods have evolved over the years. Insurers have tried and tested different distribution channels. One channel that has been prevalent all along is the intermediary channel. An intermediary plays an essential role in the entire life cycle of a product, from point of sale to policy administration and claims handling. Insurance intermediaries serve as a bridge between consumers (who want to buy insurance) and insurance companies (who want to sell those policies). In terms of numbers, more than 99% of life insurance policies are sold through personal sales channels or intermediaries in terms of premiums. For the remaining 1%, premiums are paid via comparison platforms on the internet or other online channels. In terms of the number of policies sold, the share of personal sales is reduced to 98.75%, while online channels and comparison platforms contribute 1.25%.

Trends in insurance sales

The expectations of insurance customers are constantly changing. We show you three trends that are shaping insurance sales and what customers want today.

Trend 1: Digital change in insurance behavior

Today, people working from anywhere in the country have easy access to the Internet via computers, cell phones and other portable devices. They use the Internet to gather information about their insurance policy, compare two policies and conduct transactions with the insurer. The buying experience can vary depending on the type of insurance products. For example, customers still prefer to seek advice from agents and brokers when buying life insurance. Whereas products such as home and car insurance are more standardized and require less staff involvement.

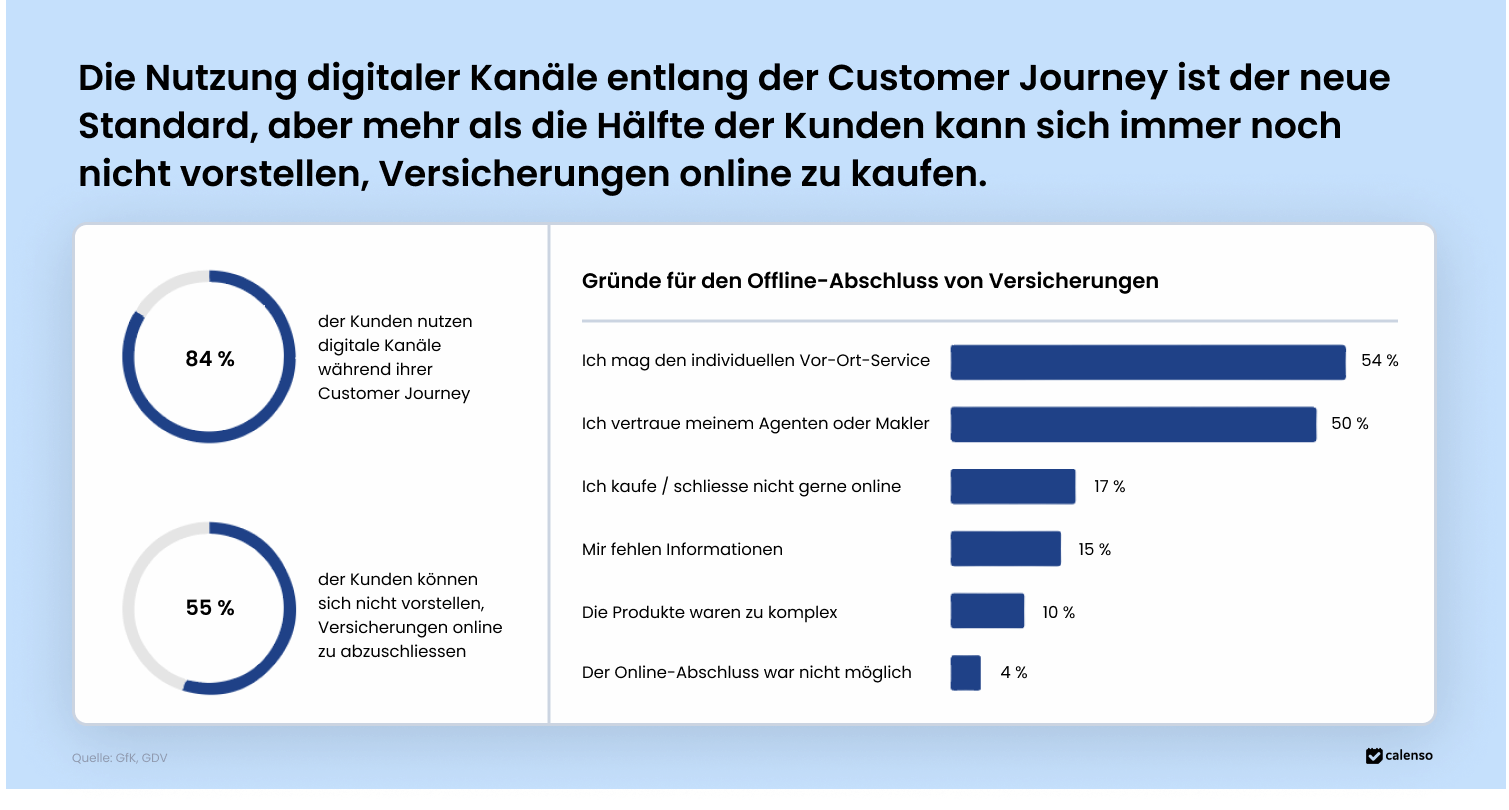

According to a report by McKinsey, the use of digital channels along the customer journey has become standard. However, more than half of customers still can't imagine buying insurance online. To appeal to the younger ones such as millennials, Gen Zs and the generations yet to come, insurers need to use mobile channels such as the internet to sell their products. This can be done in the following ways:

- Integration of robust self-service portals into the customer journey.

- Identification of products that are likely to be sold online.

- Analysis of customer behavior and creation of targeted marketing strategies.

With its omnichannel solution, Calenso can help insurers to reduce their operational workload and increase customer satisfaction at the same time.

Find out how omnichannel solutions are improving the insurance industry. →

Trend 2: Customer journey in insurance sales: advantages of SaaS solutions

Technological progress has increased the number of insurance sales channels. As a result, new technology platforms have emerged to enable a seamless customer journey. Today, a customer's buying journey is fragmented and spread across different touchpoints: Insurer, intermediary and customer.

Increasing competition between different insurance providers requires accelerated product and service delivery across different channels. Industry analysts estimate that the SaaS market will grow by more than 20 percent annually and will reach almost 200 billion US dollars by 2024. Insurance companies should use SaaS solutions like Calenso to interact with consumers and sell insurance through the customer's preferred channel. This can be achieved through the following:

- Provision of personalized services for consumers via the various channels used by the customer.

- Keep the customer in mind and speak to them when they need you most.

- Use of reports from SaaS platforms to analyze the performance of different channels.

- Analysis of customer behavior to predict the customer's next move and act accordingly.

- Utilize third-party integrations to interact and follow up with customers through various social media channels.

How digitalization strengthens your customer loyalty

Take a look at our project with Sanitas Health Insurance, where Calenso developed a comprehensive digitization suite that optimizes appointment management and increases customer satisfaction.

Trend 3: How do you digitize existing sales channels?

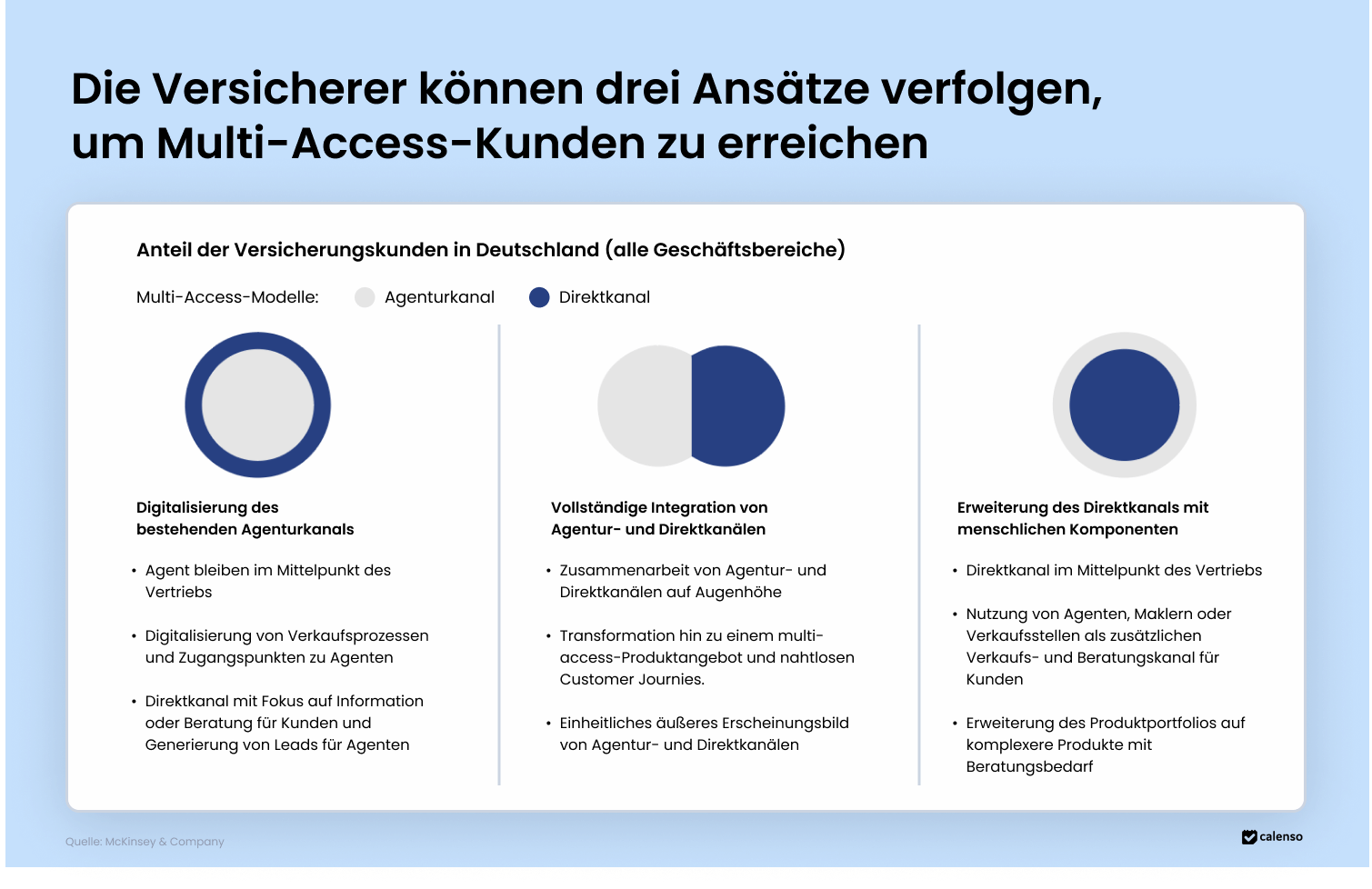

Only 40% of insurers have a digital strategy, although most claim a range of best practices. Two-thirds of insurance executives believe digital adoption will remain a trend even after the pandemic. Today, intermediary channels such as agents and brokers sell insurance. To meet customer demands, digitalization must start with existing sales channels. The idea is to support the sales activities of the existing network of insurance agents. Agents need to use digital tools to improve the customer experience. This can be achieved through the following:

- Training insurance agents to advise potential customers via digital channels.

- Provide digitized tools for agents to perform daily processes such as appointment scheduling and payment tracking.

- Notification of agents via digitized tools for upsell or cross-sell opportunities.

- Cooperation between agents and direct channels on an equal footing.

Calenso can play a key role here by providing a platform that supports agents and brokers to make their work more efficient and optimize the customer experience.

From brokers to multi-channel

Traditionally, insurance companies had agents and brokers as their primary interaction channel with their customers. This "100 percent" approach has all but disappeared. Today, customers demand multiple access points to interact with their insurer during their customer journey. This mix of touchpoints makes customer engagement far more complex. A recent study by the German Insurance Association (GDV) shows that more and more consumers are taking out their insurance policies online. In the areas of property, accident and liability insurance in particular, the proportion of new policies taken out digitally rose to 16.4% in 2021. Despite increasing digitalization, the proportion of policies requiring intensive advice, such as life insurance, that are taken out online remains consistently low.

A survey revealed that 84% of German respondents use digital steps along the customer journey. At the same time, 55 percent cannot imagine actually buying an insurance product online. The majority of German customers prefer to switch channels during the customer journey.

Possibilities to digitize the distribution channels

With new challenges arising every day in this complex market, the insurance sector is looking for ways to digitize distribution channels to optimize costs, improve overall accuracy and maximize returns. Insurers can use intelligent automation to quickly automate critical processes, achieve greater efficiencies and optimize operating costs. The right system, such as the one Calenso offers, enables insurance companies to support customers throughout their lifecycle and extend their customer journey with the company, rather than just providing services in the moment.

Trends in insurance distribution and multi-access solutions will see a shift from a product-centric to a customer-centric approach. It will be shaped by new digital advances, with social and peer-to-peer networks and smart devices playing a role. By predicting customer behavior, data can be made instantly accessible, which in turn helps to optimize sales efforts. In this way, consumers will feel that their needs are understood and met in a 'quick and convenient' way, ultimately helping to strengthen customer loyalty.

Frequently asked questions about multi-access sales strategy for insurance companies

What different sales channels are there in insurance?

Insurance companies can sell their policies through numerous distribution channels. These distribution channels can be direct channels such as e-commerce, internet, telesales, etc. and own sales outlets or intermediary channels such as agents, brokers, retailers, banks, etc.

What are the trends in insurance sales and how do multi-access solutions play a role?

Insurance sales are constantly evolving and adapting to new technological and social trends. Important trends include increasing digitalization, the use of artificial intelligence (AI) for customer service and risk assessment, and the growing importance of personalized offers. Multi-access solutions play a central role here, as they offer customers the opportunity to access insurance services via various channels such as online platforms, mobile apps, personal advice and physical points of sale. These approaches improve the customer experience by offering flexibility and convenience.

What is a direct sales channel?

A direct sales channel is when the insurer sells directly to the consumer. For example, by selling directly through the website, through a physical store or using its own point of sale.

How can both online and offline sales channels in the insurance industry be optimized?

Online and offline sales channels can be optimized in the following ways:

- Digitization of existing sales channels

- Cooperation with both agents and direct channels on an equal footing

- Provision of digital tools for intermediaries

With Calenso as a partner, insurers can implement a seamless and efficient omnichannel solution that integrates and optimizes both online and offline channels.