Calenso is increasingly talking about Stripe as a payment service provider on its website. To help you understand what this is all about, we would like to explain payment gateway providers such as Stripe and Paypal. We also want to show you why we chose Stripe.

What are payment gateway providers?

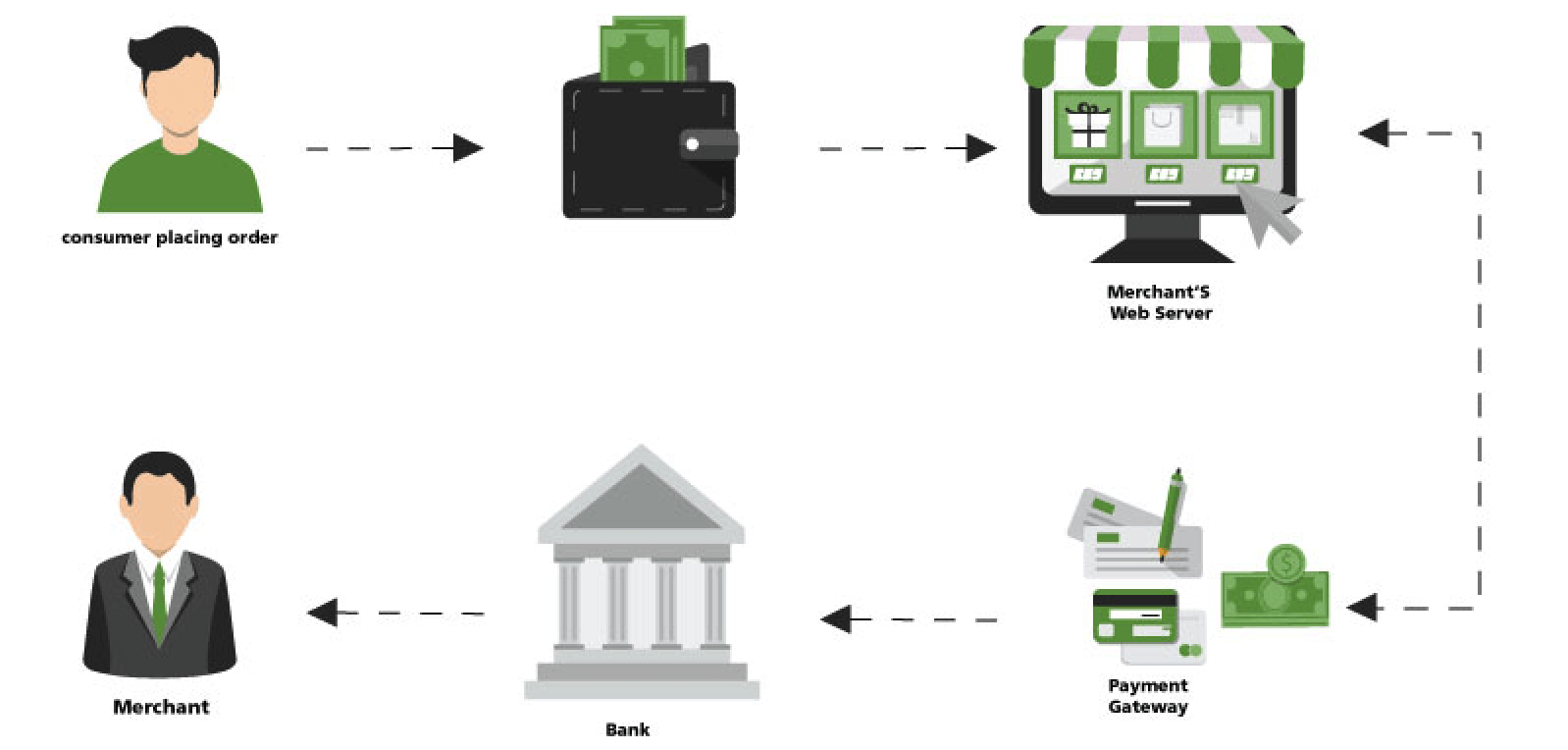

If you want to sell something online, you often need a service provider to provide a secure interface between you and your customer. Otherwise you won't be able to process online purchases. A payment gateway does this and much more. You can think of a payment gateway as a watchdog for your data.1

The process takes place between you and your customer - so far so good. In the first step, payment requests from an online store are transmitted to the credit card or payment provider via a gateway. The payment processor then provides all the necessary means for the payment to be processed. As soon as the processing has been completed, the customer's money is credited to the merchant's account.1

Image source: DUE

Are payment gateways secure?

Each provider uses its own or slightly different security measures. In principle, however, these are of a very high security standard and process data securely and reliably. In addition, these processes are operated externally by your company. The provider is therefore responsible for ensuring that the data is secure. An additional advantage of this is that data security requirements are constantly changing. The provider also takes on this responsibility and adapts to these requirements in order to meet the highest security standards. 1

Two things must be fulfilled: PCI-DSS standard and GDPR compliance. The PCI-DSS standard is a security standard for handling credit card data. It is very complex and expensive and should therefore be transferred to the payment intermediary. The data is encrypted using a PCI-compliant procedure and processed by the payment intermediary. This means that data never comes into contact with you or with Calenso. The PCI-DSS standard at level 1 is the highest standardization possible. With regard to data protection and security requirements, GDPR compliance serves.

Since Calenso uses Stripe, all data related to your payments or payments from your customers to you are stored with them. This means that no such data could be retrieved in the event of a hacker attack on Calenso. The data is completely secure thanks to Stripe's high security standards. This makes life easier for Calenso and gives you full data security.

What is Stripe?

Stripe is currently one of the largest payment gateway providers. The company has developed enormously in recent years and is now available in over 20 countries and accepts more than 135 different currencies. If you want to accept payments, you can simply create an account. Your customers won't hear anything from Stripe. They simply pay by credit card as usual. Stripe offers the highest security standards, such as PCI DSS Level 1 certification, license as "E-Money" in Europe, PSD2 compliance with strong customer authentication, SSAE18/SOC 1 Type 1 and Type 2 reports and SSAE18/SOC 2 Type 1 reports and many more.2

Stripe is one of the most user-friendly payment service providers. They also disclose all code to make integration as easy as possible for developers.

What is Paypal?

Paypal is one of the best-known payment gateway providers - especially among customers. It accepts payments from 200 different countries and 25 different currencies. An e-mail address and password must be defined for a Paypal account, and a credit card or bank account must be linked. Customers can pay conveniently using the familiar "Paypal button" with their e-mail address and password. As a Paypal account holder, transfers can be made to e-mail addresses or money can be requested from other Paypal customers. 3

Paypal also has buyer protection. This protects the customer if an order does not arrive. Paypal also offers other services, such as free returns. 4

What advantages does Stripe offer?

Basically, both providers are quite similar. Let's take a look at some of the criteria.

Supported means of payment

Paypal supports the following payment methods:

- PayPal

- Credit cards

- Debit cards

- Pay by phone

- PayPal Credit

And Stripe the following:

- Credit cards

- Debit cards

- International cards

- AmEx Checkout

- Masterpass by MasterCard

- Visa Checkout

- WeChat Pay

- AliPay

- Apple Pay

- Google Pay

- ACH credit and debit

- SEPA direct debit

- And more

This view is actually already convincing as to why Stripe was preferred by Calenso. 5

Costs

With Paypal, the fees per transaction are 3.4% of the amount and an additional CHF 0.55.6 Stripe, however, charges only 2.9% of the amount and an additional CHF 0.30. 7

Another advantage that speaks in favor of Stripe.

Further advantages of Stripe

These are actually the main advantages why Stripe was chosen over Paypal. However, Stripe offers much more. For example, the purchase process is faster and more user-friendly for your customers. 8 In addition, life is a lot easier for developers with Stripe. They provide transparent documentation of the codes and offer versatile integration. 9

If you have any questions about Stripe or our online payment processing, don't hesitate to contact us. You can find the documentation on Stripe and how to use it here.